Resources and Stories for Real People

Our financial blog offers valuable information on wealth planning and investment management and provides perspectives on how to communicate more effectively and get organized when it comes to finances.

Financial Accomplishments – The Millennial Generation

There is a lot of evidence that suggests that are facing unique challenges that older generations never had to encounter, as it relates to finances. With this backdrop, it’s easy to see that Millennials have actually accomplished quite a lot despite having to navigate the 2008 financial crisis, as well as overcoming a

Aging Parents: Can a Home Remodel Allow Your Parent to Age in Place?

When it comes to living independently as we age, much has to do with our surroundings. Many people wish to remain in their homes and age in place, but this is not always manageable. If you are helping your aging parents determine their options, it’s worthwhile to ask whether retrofitting

Pandemic Fatigue

Back in January 2020, I sat down to draft some personal and professional goals for the year, as I know many people do. Pencil and paper in hand, super pregnant, I neglected to add “navigate a global pandemic” to my list of hopeful future achievements. At the time, I was

Presidential Elections: What Do They Mean for Markets

THIS ARTICLE IS FROM DIMENSIONAL ADVISORS. READ THE ORIGINAL ARTICLE HERE. It’s almost Election Day in the US once again. While the outcome may be uncertain, one thing we can count on is that plenty of opinions and predictions will be floated in the days surrounding the vote. In financial circles,

Elections and the Stock Market

The market continues to reach new highs although many stocks in the S&P 500 are still below their previous highs. For example, as of this writing, 40% of S&P 500 stocks are 20% below their highs. The market is reaching new highs on just a handful of stocks; including Microsoft,

College Planning: 529 College Savings Plans

As a parent, you want the very best future for your children – but what happens when that future comes at a substantial cost? If you dream of a private school college education for your kids, it just might.

More Articles

Taking Stock of Lump-Sum Investing vs. Dollar-Cost Averaging

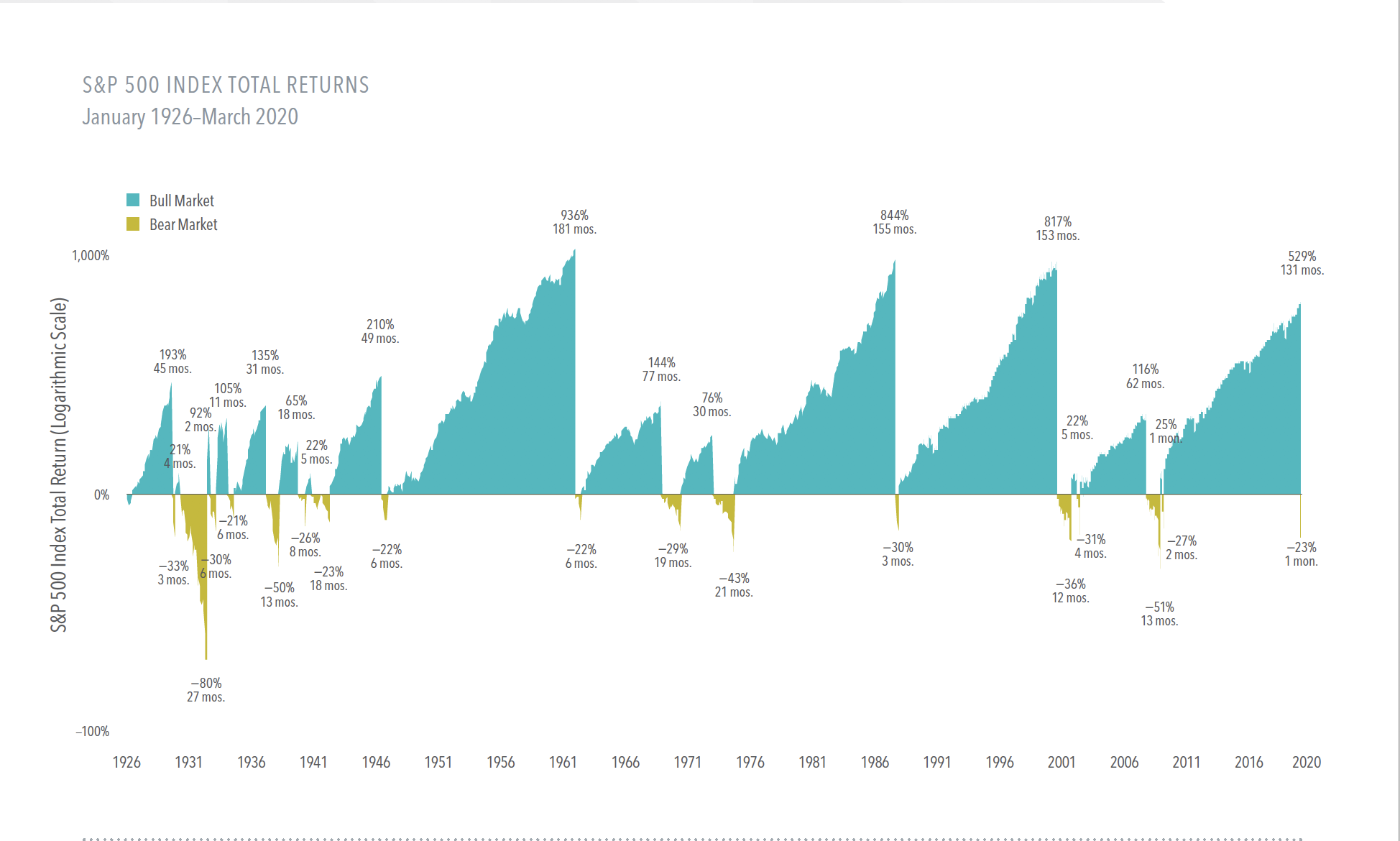

Bulls, Bears, and Long-Term Benefits of Stock Investing

Are You Ready to Upsize?

Retirement Planning for Millennials: A Complete Guide

The Millionaire Within

Intelligent financial decision-making is not about money. It’s about emotions, behavior, and unleashing the power that lies within you.

Begin Your Journey

Our initial discovery meeting is complimentary and gives us the opportunity to provide information and resources about who we are and what we do, so that you can make an informed decision about who you choose to work with on the future of your wealth.